Monday, September 25, 2006

A Rose by any other name is still a Rose!

Dubai has plans to make itself a commerical center for flower trade, allocating land and resources for the same. The producer of the world, china is also taking a strong look into the flower power to sustain rural growth.

Saturday, September 16, 2006

Yahoo! Mail Beta

You can find screenshots of the new Yahoo!Beta here. I was given a option to try the beta version, however, could not even login-in to the system. After all, it is still Beta!

Monday, August 21, 2006

Graphical Representation of this blog (and the net)

Saturday, August 19, 2006

Why is living in dubai so bad?

- Divided society among various nationalities and religions. Some of the best friends were Arabs when I stayed in united states, however, I am ashamed to say I know nobody here.

- Ever-bickering intra-communities. The kind of "keeping up with the Jones" among various communities is taken to an extreme here.

The other side of the coin is to look at it in terms of economics. The amount of disposable income proportional to your earnings was historically (not at present) high. The avenues for spending money or investments are limited since you cannot make the most important expenditure, i.e, your house. You got to spend money, thus, the high level of "Bling" in dubai.

How would you rectify it?

- Allow people to invest in this society. People care about their investments; society will improve itself.

- Encourage social connections between various people. The areas of dubai are divided into ethnic groups, with few or no exceptions. The idea of encouraging high-rise buildings in Abu Dhabi, I believe, was to control populations in case of a uprising due to any reason. This thought is out-dated and needs to be corrected. The recent problems in France is only but an indication of what is to come.

- Most importantly, improve educational institutions including universities. Students merge among other communities with little or no pre-conceived notions and good educational experiences will lead to better dubai-community.

Thursday, August 17, 2006

When is security too much to pay?

I might be out on a limb here but what are the chances of an 60 year old women fusing about some cream - she was not allowed to take on the flight- a security risk? I mean, please I would take all the chances in the world in that sitution. I understand that the threat level is high and chances of a western target being attacked are quite high, but do 6o year old women who most lively lived here whole life in western countries want to detonate something? I would be suprised if she succeeded in hitting somebody with her walking stick.

Regardless of what the people think, terrorists are not crazy by birth. Rational thought and process is behind every action. It is, however, the assumptions that are to be blamed. In the movie "K-PAX", one of the scences shows a "crazy" man trys to hide under benches and avoiding sunlight. It is revealed that he believes sun rays will kill him, so he avoids them. His hiding behind benches is only the reaction.His thinking is not irrational, his assumptions are what is the problem to be resolved.

Similar is the case against the terrorists. They are not irrational human beings, they have come to believe in assumptions which you and i dont believe to be true. Any problem in this world can be solved if both sides can try to understand the assumptions and the reasons behind the assumptions that make up the conflict. Destroying cities, towers and subways will not change the assumptions. Open minded constructive critical thinking will.

Wednesday, August 09, 2006

Burj Dubai Facts and Figures

- Upon completion, the Burj Dubai will be the world's tallest building as well as the world's tallest man-made structure. (more here on present tallest man-made structure)

- The Burj Dubai spire will be visible from as far away as 95 kms.

- At 5,500 kg capacity, the firemen/service elevator will be the world's tallest service elevator.

- First mega-rise to have elevators with specially programmed, permit-controlled evacuation procedures. (I wonder how they work? Weren't we supposed Not to use evaluators in case of an emergency)

- Highest publicly accessible observation tower at 442 meters. ( Go up and watch miles and miles of desert as well as ocean I guess!)

- The curtain wall of Burj Dubai will be equivalent to 17 football fields.

- The total glass requirement is 142K sq/m

- Total concrete used is equivalent to 1900km sidewalk and weighs the equivalent to 100,000 elephants.

- There will be 200 meters of "dancing" fountains at the foot of Burj Dubai.

- Power requirement is 36 KVA is equivalent of 36K lights bulbs of 100 watts each operating at the same time.

- The cooling requirement is 10K tonnes of melting ice every day.

- 15 Million gallons of supplemental water are collected and drained every day

Friday, August 04, 2006

Dubai's Banking Sector in the world news!

But this is set to change. Among the proposals in the pipeline is a Valued Added Tax and allowing businesses to have 100% ownership of companies outside the freezone areas. (compared to 51% - 49% ownership structure at present) All these regulations will help UAE to develop their financial sector.

Yahoo News has a related news article.

Friday, July 28, 2006

Lessons Dubai Can Learn

Love This!

If there is ever a reason why dubai would fail as a modern, forword-looking city along with the great visions of its leaders, it is due to the backward looking pressures from certain sections of the society.

If there is ever a reason why dubai would fail as a modern, forword-looking city along with the great visions of its leaders, it is due to the backward looking pressures from certain sections of the society.That said, etisalat is providing servies in censorship that is needed to limit the shock effect on large section of the conservative society. Given a choice between having large section of the population surfing the net with censorship or having parents ban internet in their homes due to lack of blockage of inproper sites, i would prefer the earlier. I have noticed societies in the middle east *tend* to take extreme measures in most aspects. (Please feel to correct me if i am wrong!).

What is needed is a proxy-free internet for people who need it. Maybe something like the liqour license the govenment has. I know this is a money making idea, but money is what moves the organizations here. Atleast that would be a good start.

Now as for the reasons behind the proxy, that issue is a debate on its own merits.

Monday, July 03, 2006

Friday, June 30, 2006

Do Skyscrapers make sense?

Saturday, June 24, 2006

Yahoo! 360 Blocked

UPDATE: Looks like Yahoo! 360 is back!.. I should have taken a screen shot :-)

Friday, June 23, 2006

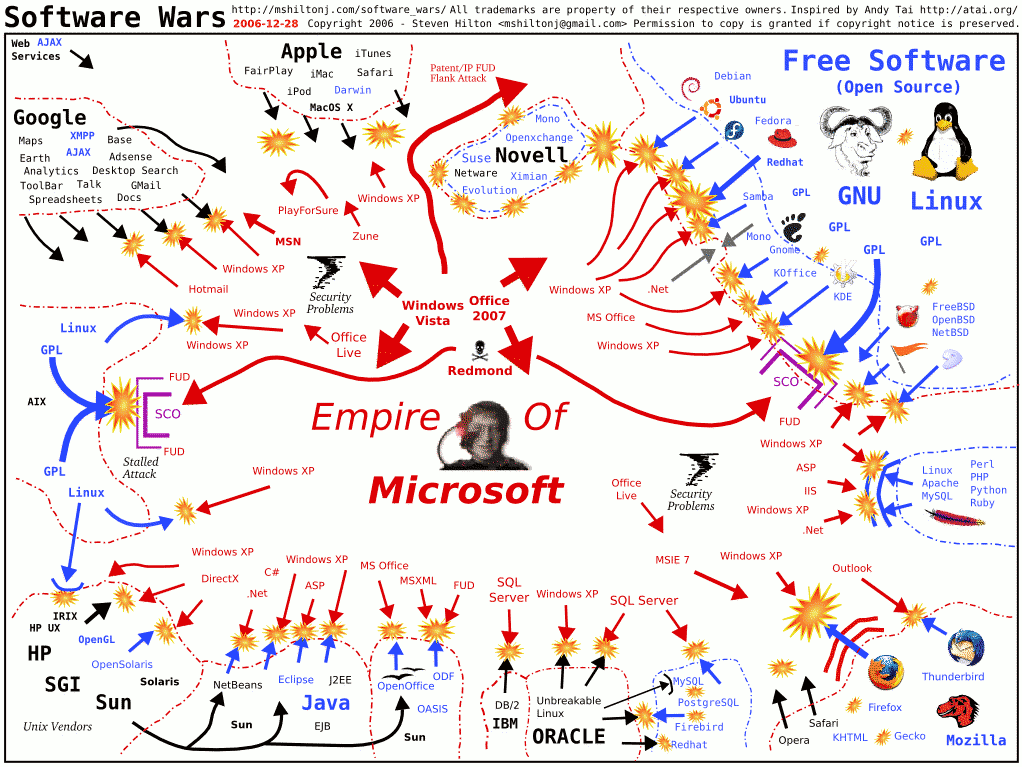

Software Wars

Sunday, June 04, 2006

UAE Year Book 2005

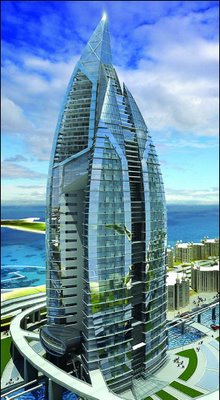

Re-designed Trump Tower

I recently came to know about the re-design of new Trump Building coming up as the center piece of plam jumairh. Although I believe no financial investment is being contributed by Mr. Trump, he would lend his name as well as his expertise in the new project. Notice the plam metro going through the new building.

I recently came to know about the re-design of new Trump Building coming up as the center piece of plam jumairh. Although I believe no financial investment is being contributed by Mr. Trump, he would lend his name as well as his expertise in the new project. Notice the plam metro going through the new building.

Thursday, June 01, 2006

NY Times take on Air Arabia and Low cost airlines in the Gulf

Tuesday, May 30, 2006

Banks Closed Friday and Saturday (Most likely)

I am posting this, since I saw some letters in 7 days regarding banking hours after the new working schedule comes into effect.

Saturday, May 27, 2006

News Article on Coal from NYT ( Coal Theme: 2)

WRIGHT, Wyo. — More than a century ago a blustery Wyoming politician named Fenimore Chatterton boasted that his state alone had enough coal to "weld every tie that binds, drive every wheel, change the North Pole into a tropical region, or smelt all hell!"

His words seem prophetic.

The future for American energy users is playing out in coal-rich areas like northeastern Wyoming, where dump trucks and bulldozers swarm around 80-foot-thick seams at a Peabody Energy strip mine here, one of the largest in the world.

Coal, the nation's favorite fuel in much of the 19th century and early 20th century, could become so again in the 21st. The United States has enough to last at least two centuries at current use rates — reserves far greater than those of oil or natural gas. And for all the public interest in alternatives like wind and solar power, or ethanol from the heartland, coal will play a far bigger role.

But the conventional process for burning coal in power plants has one huge drawback: it is one of the largest manmade sources of the gases responsible for global warming.

Many scientists say that sharply reducing emissions of these gases could make more difference in slowing climate change than any other move worldwide. And they point out that American companies are best positioned to set an example for other nations in adopting a new technique that could limit the environmental impact of the more than 1,000 coal-fired power projects on drawing boards around the world.

It is on this issue, however, that executives of some of the most important companies in the coal business diverge. Their disagreement is crucial in the debate over how to satisfy Americans' growing energy appetite without accelerating climate change.

One of those executives, Michael G. Morris, runs American Electric Power, the nation's largest coal consumer and biggest producer of heat-trapping carbon dioxide emissions from its existing plants. He is spearheading a small movement within the energy industry to embrace the new technology. His company plans to build at least two 600-megawatt plants, in Ohio and West Virginia, at an estimated cost of as much as $1.3 billion each.

The company says these plants are not only better for the environment but also in the best interests of even its cost-conscious shareholders. While they would cost 15 to 20 percent more to build, Mr. Morris says they would be far less expensive to retrofit with the equipment needed to move carbon dioxide deep underground, instead of releasing it to the sky, if limits are placed on emissions of global warming gases.

"Leave the science alone for a minute," Mr. Morris said in an interview at the Columbus, Ohio, headquarters of his company. "The politics around climate issues are very real. That's why we need to move on this now."

But most in the industry are not making that bet. Among them is Gregory H. Boyce, chief executive of Peabody Energy, the largest private-sector coal producer in the world thanks in part to its growing operations here in Wyoming and with aspirations to operate coal-fired plants of its own. Mr. Boyce's company alone controls reserves with more energy potential than the oil and gas reserves of Exxon Mobil.

"We're still not convinced that the technology or cost structure is there to justify going down a path where we're not comfortable," Mr. Boyce said.

Mr. Boyce's view has prevailed. No more than a dozen of the 140 new coal-fired power plants planned in the United States expect to use the new approach.

The decisions being made right now in industry and government on how quickly to adopt any new but more costly technologies will be monumental.

"Coal isn't going away, so you have to think ahead," said Gavin A. Schmidt, a climate modeler at the Goddard Institute for Space Studies, part of NASA. "Many of these power stations are built to last 50 years."

Promise and Perils

Michael Morris and Gregory Boyce, both kingpins in their industries, have a lot in common. They do a lot of business together — Mr. Morris is one of Mr. Boyce's largest customers. They are solid Republicans. And they serve together on various industry initiatives.

They agree that energy from coal — the nation's most important source of electricity — is cheaper than energy from oil and natural gas and is competitive with the uranium used in nuclear power plants. And coal could serve new uses: replacing petroleum in making chemicals, for example, or even fueling vehicles.

But while sooty smokestacks are no longer a big problem in modern coal-burning power plants, the increase in global warming gases is. A typical 500-megawatt coal-fired electricity plant, supplying enough power to run roughly 500,000 homes, alone produces as much in emissions annually as about 750,000 cars, according to estimates from Royal Dutch Shell.

Coal has perhaps no stronger evangelist than Mr. Boyce, who grew up on Long Island, the son of a mining executive, and studied engineering in Arizona. He argues that a way to reduce carbon dioxide emissions can be found without having to switch from the existing cheaper coal-burning technology.

Much in the way that Exxon Mobil influences discussion of climate issues from the petroleum industry, Peabody is a backer of industry-supported organizations that seek to prevent mandatory reductions in global warming emissions and promote demand for coal.

Peabody's executives are also by far the coal industry's largest political contributors to federal candidates and parties, giving $641,059 in the 2004 election cycle, with 93 percent of that amount going to Republicans, according to the Center for Responsive Politics, an independent research group in Washington that tracks money in politics. And while Peabody says it expects contributions to Democrats to increase, under Mr. Boyce the company has cultivated close contact with the Bush administration.

Mr. Boyce was chairman of an advisory panel for the Energy Department, organized by the National Coal Council, that produced a controversial report in March calling for exemptions to the Clean Air Act to encourage greater consumption of coal through 2025. The thrust of the report, which Mr. Boyce outlined in an interview, is that improvements in technology to limit carbon dioxide emissions should be left to the market instead of government regulation.

By contrast, the environmental advocacy group Natural Resources Defense Council, which has brought many lawsuits aimed at controlling pollution, described the report as an "energy fantasy" that would increase carbon dioxide emissions by more than 2 billion tons a year.

But it is Peabody's economic argument, not the environmental opposition's, that is resonating throughout the electricity industry and among energy regulators.

Led by Peabody, dozens of energy companies have embarked on the most ambitious construction of coal-fired electricity plants since the 1950's.

Coal, as Mr. Boyce notes, is a bargain. Despite a doubling in domestic coal prices in the last two years, a surge in prices for natural gas, the preferred fuel for new power plants in the 1990's, has made coal more attractive.

With coal so favorably priced, Peabody saw an opportunity to enter the power-plant business itself, setting out to build two of the largest in the world, the 1,500-megawatt Prairie State Energy Campus in southern Illinois and the 1,500-megawatt Thoroughbred Energy Campus in western Kentucky. Both are in areas where the St. Louis-based company has substantial coal reserves.

Despite growing concern among some large energy companies over the liabilities they face if global warming advances or legal limits on carbon dioxide emissions become a reality, Peabody remains loyal to its technology choice. Vic Svec, Peabody's senior vice president for investor relations, said the possibility of near-term caps on carbon emissions was not viewed as a "material threat."

A Bet on Clean Technology

Mr. Morris, at American Electric Power, sees things differently. He cites cost concerns in arguing for its move to cleaner technology. At the request of environmental groups that hold shares in the company, A.E.P. agreed in 2004, shortly after Mr. Morris arrived, to report on the potential costs it would face if emissions rules were tightened. The company recognized that its growth beyond 2010 could be limited if it stuck with old technology.

The company has since won important allies in its push for cleaner coal, including General Electric, which is pinning much of its hopes for growth in the electricity industry on new technology and is working with A.E.P. on designing its plants.

One vital element of A.E.P.'s ambitions, and by extension those of other energy companies with similar projects, fell into place in April when the Public Utilities Commission of Ohio allowed the company to bill customers for a portion of the higher pre-construction costs for the plant it is planning in the state. The company hopes to complete construction of its first such plant by 2010.

Proponents of these plants, which turn coal into a gas that is burned to produce energy, say they would also emit much lower amounts of other pollutants that contribute to acid rain, smog and respiratory illness.

But for every small advance of the new technology, there are bigger setbacks. Many within the industry argue that it would be a waste of time and money to build such plants in the United States unless China, which passed the United States several years ago as the largest coal-consuming nation, also moves to limit carbon dioxide emissions from its rapidly growing array of coal-fired plants.

Will Government Act?

With widespread uncertainty in the state-regulated power industry, the debate has moved to the federal level, where testimony by senior energy executives before the Senate Energy Committee in April revealed a sharp fault line within the industry.

On one side, A.E.P., lined up with Peabody and other heavy coal users against mandatory limits on global warming gases if industrializing countries like China and India are not included. Others that have less to lose from carbon caps — like Exelon and Duke Energy, which rely much more on nuclear power — spoke in favor of national limits that would include coal consumers.

The Bush administration has rejected mandatory limits on carbon dioxide emissions. But there is some support in Washington for such legislation. The two senators from New Mexico, Jeff Bingaman, a Democrat, and Pete V. Domenici, a Republican, are working on a bill that could require limits on carbon dioxide emissions.

Ahead of the 2008 presidential election, two senators often mentioned as candidates, Hillary Rodham Clinton, Democrat of New York, and John McCain, Republican of Arizona, have endorsed mandatory cuts in emissions. Mr. Morris of A.E.P. said such support has persuaded him that limits might be imposed in coming years.

While Peabody supports some coal gasification projects, it remains skeptical about departing from traditional coal-burning methods to produce electricity.

The pulverized coal plants it wants to build, which grind coal into a dust before burning it to make electricity, currently cost about $2 billion each, or 15 percent to 20 percent less to build than the cleaner "integrated gasification combined cycle," or I.G.C.C., plants, which convert coal into a gas.

The hope among scientists is that I.G.C.C. plants could be relatively quickly fitted with systems to sequester deep underground the carbon dioxide created from making electricity. Without such controls, the new coal plants under development worldwide could pump as much carbon dioxide into the atmosphere over their lifetimes as all the coal burned in the last 250 years, according to Jeff Goodell, who has written on coal for several publications, including The New York Times, and is author of a new book on the coal industry.

But state and federal regulators have been hesitant to endorse the technology. Peabody and other companies remain skeptical that carbon-capture methods, whether for pulverized coal or combined cycle plants, will become commercially or technologically feasible until the next decade.

Legal battles over this reluctance have already begun, with the Natural Resources Defense Council and the American Lung Association this year challenging the Environmental Protection Agency for allowing electric companies to move ahead with power plant projects without evaluating the new technology.

In one key decision on the state level, the Wisconsin Public Service Commission rejected a proposal from WE Energies of Milwaukee in 2003 to build a plant with the new technology, saying it was too expensive and would result in higher electricity prices.

Capturing the Gas

Engineers have known how to make gas from coal for more than a century, using this method in the gaslights that first illuminated many American cities. A handful of coal gasification plants are already in operation in the United States, Spain and the Netherlands, built with generous government assistance.

Selling the captured carbon dioxide from coal gasification plants could make them more competitive with pulverized coal plants. One gasification plant in North Dakota, though different from an electric plant, already sends its carbon dioxide to Saskatchewan, where it is injected in aging oilfields to force more crude from the ground. And the oil giant BP announced a similar project in March for a refinery it owns near Los Angeles, using petroleum coke as a fuel there instead of coal.

Scientists have developed numerous other plans to pump away carbon dioxide, like shipping it to offshore platforms to inject it below the ocean floor. These plans are not without risk, with some officials concerned that carbon dioxide sequestration could trigger earthquakes. Yet, time and again, the most limiting factor remains economics.

As they proceed with plans to build pulverized coal plants, Peabody and other companies often point to their support of the alternative technology through their participation in Futuregen, a $1 billion project started three years ago by the Bush administration to build a showcase 275-megawatt power station that could sequester carbon dioxide and reduce other pollutants.

Futuregen's 10 members include some of the world's largest coal mining companies, among them Peabody and BHP Billiton of Australia, as well as large coal-burning utilities like A.E.P. and the Southern Company.

One Chinese company, the China Huaneng Group, is also a member of Futuregen, while India's government signed on in March. Washington is financing the bulk of the project, more than $600 million, with about $250 million coming from coal and electricity companies and the rest from foreign governments.

But Futuregen is already behind schedule, with planners now hoping to choose a site for the plant by the end of the year, with an eye on starting operation by 2012. Environmental groups have criticized the project as too little, too late.

"Futuregen is a smokescreen, since it's not intended to bring technology to the market at the pace required to deal with the problem," said Daniel Lashoff, science director at the climate center at the Natural Resources Defense Council. "We don't have that kind of time."

Thursday, May 25, 2006

Energy and Geo-Green

Above is the graph of Crude oil prices over the last one month. And most of the other commodity prices are showing similar violently. The issue for at least oil is one of geo-politics influencing an already strained supply chain of crude oil. Nations such as

(Another commodity which has been in the news lately is gold, which occupies a unique position as both a commodity (as in raw material used in various functions) as well as safe haven currency.)

Coming back to oil, and more accurately energy it represents to the consumers, energy demands are increasing ever more where as the supply is limited to fossil fuels. Fossil fuels mainly are oil, natural gas and mostly forgotten but very important material Coal.

Coal enjoys some of the highest demand in the world since significant amount of electricity in the world is produced by burning coal. It is a very effective raw material for energy as long as transportation charges are not huge.

Coal is one of the “re-discovered” energy sources of

Why am I talking about coal now? Because I am reading Coal: A Human History. Economic History books have always interested me, however, this book is more than economic history of coal, and the book describes history of the evolution of industrial lifestyle and labor movements. Imagine carrying sand along with you during a train ride, incase somebody next to you would catch fire?

Wednesday, May 03, 2006

Video

and then read below.

Few Ads have had a successful run in United States as the Verizon wireless. The dude with "Can you hear me now?" is now synonymous with Verizon dedication to providing one of the largest mobile-coverage network areas.

Sunday, April 23, 2006

For those of you interested in Learning

Saturday, April 22, 2006

Dubai Income from Investments

The website of the magazine is published as www.thebusinesscorridor.com; however, i was not able to open their site.

In related news, Dept of finance is set to launch AED 12 Billion term loan/bond issue soon with the help of some 5 local and international banks. (Full article also in the magazine)

I believe the magazine is available in newspaper stands now.

Sunday, April 09, 2006

Dubai Inc

Profile: Dubai Inc. , part of UAE Group, has been the forefront in many a sectors over the last half a century. Started out as a port, major revenues for most of its history was generated by port operations. That is until, Oil was discovered by the company and quickly become one of the major revenues of the company. Over the last two decades, Dubai Inc is diversifying its revenues from oil to include tourism, property markets, telecom, transportation and business services.

Revenues for Dubai Inc are mainly oil sales for a considerable period of time, however now constitute a minority as revenues from other sectors have taken over. Costs are marginal thanks to low costs of outsourcing human labor.

More about the various companies/depts under Dubai Inc. Coming soon. Accounting Department;Information Technology/Telecom;Finance;Marketing;Human Resources.

Sunday, April 02, 2006

Banning Cycling!

The Municipality is apparently trying to clamp down on “uncivilised” people who transport scrap, especially cardboard, on the back of bikes.

Would it be not more benifical to implement good wastage collection system? Banning the cheapest available mode of transportation is not the solution! Considering that most of the public transportation in UAE is stuck in dark ages and markets the future as 22nd century city; the government must realise the future of public transportation is in the direction taken by cities such as San Francisco which has the one of the longest biker routes of the world and not in cities like LA, known worldover for its traffic jams and highways.

Friday, March 24, 2006

On the Labour Issue

Most of the constuction companies in UAE are controlled and managed by few well known groups and individuals here. If the government decides to control the system, it would again come down to the same management here. After all, not everyone can manage a constuction company, fewer in "locals". Moreover, the government needs to get out of businesses, not involve in more. As far as a social system is concerned, forget expats; these guys are slowly learning to take care of their own social needs (of locals) in many aspects.Recent disability laws are proof in that direction.

The issue with non-payment and ill treatment of labours in UAE has more to do with incompetent embassies and middle men between the native village in india/pakistan/etc and final job. Most of these people take up huge debts to come to the gulf, and the repayment plan prevents them to say "f**k off" to their incompetent employers. Unfortunely, the worst treatment occurs in cases where indian works for an indian-managed company etc.

I believe, the solution to this problem lies in good-old competition. Let forign companies (having western standards) compete for constuction projects including actual contruction. (Right now, most of the companies are based out of UAE, with sub-continent labour.) And allow free movement of labour from one company to another. Laws like the six-month ban for unskilled labour do not allow free flow of labour in UAE, especially for unskilled labour. Hopefully, competition will improve the situation for all.

Thursday, March 23, 2006

BSE at 13000 by end of July?

Full currency convertability has been an issue for developing markets around the world. It was this ability to move away from financial markets in a giffy that resulted in the asian crisis of 1997. The whole episode was triggered by a general thinking that asian markets are going to crash, which utimately led to the crash of the 1997. More information on the asian crisis can be found here.

The government of India asssured the public on the stability of indian markets during the crisis mainly pointing to the fact that indian currency was not freely convertable. But a decade is a looong time in finanicial markets.With the proposed full convertability, indian markets have no more the tools to stop such drastic measures.

One the other hand, the move demonstrates the confidence of the government on the fundamentals of the boom. They would argue that indian markets are not dooming due to external funds rather due to domestic investment and savings. Having one of the highest current accounts surplus in the world right now also gives a good deal of confidence.

Finally i would like to end this by quoting a recent Buttonwood column in economist...

India and China might well remain Asia’s great growth stories over the coming years, but Buttonwood is not going to recommend their stockmarkets. In India’s case, that is partly because he sits too far away; partly because its valuations are—possibly justifiably—higher than they are farther east; but mainly because India’s growth story is fast becoming one in which rising asset prices (land, stockmarkets) fuel demand growth, which in turn fuels rising asset prices. India’s stockmarket, in other words, is coming to resemble Japan’s in the 1980s or the rest of Asia’s in the early 1990s. Judging when the inevitable blowout will come requires a sense of timing with which Buttonwood is not equipped.

Wednesday, March 22, 2006

Indian Names

Sunday, March 19, 2006

Open Source Business

As usual, economist has an article on the effects of open source in various aspects of business. and if it will sustain itself in the long run.

Thursday, March 16, 2006

New York Times Op/Ed

I haven't talked about DP world/Globalization/protectionism in this blog, but i can generally say that Americans are facing similar issues with globalization as did the British after the second world war. The movement of technology,industry and money across the Atlantic was fast by historical standards of that time, however that will seem like ages compared to what is now possible, both technologically as well as institutionally. The only difference is that the British had little to no say in their rapid decline from "hegemonic" position thanks to their losses in the world war. Don't expect the Americans to move from their position so easily.

Art of Making Human Organs!!

So the idea of being able to create replacement organs from scratch, using a patient's own tissues—and hence preventing rejection—has considerable allure. Dr Atala, a pioneer in the field, is now working with Tengion, a biotech firm based in King of Prussia, Pennsylvania. It is one of several firms pursuing the idea of making organs to order, but seems to have made the most progress. Already, a handful of patients in America have been quietly fitted with new bladders made using Dr Atala's technology.The approach is simple, but it has taken decades to refine. Healthy progenitor cells (the precursors to particular cell types) are extracted from the patient, isolated and multiplied in culture. They are then placed into a scaffolding structure, made of collagen, which is sculpted to resemble the required organ. This in turn is then placed into a soup of nutrients in an incubator, resembling an aquarium, that simulates the conditions found inside the human body. “Four to six weeks later, you have a ‘neo-bladder' that can then be placed into the patient,” says Dr Atala. The immune system senses nothing untoward, allowing the body to stimulate the remaining growth necessary for full functionality. The collagen scaffolding is gradually reabsorbed into the body.

Monday, March 13, 2006

The Theory Of Happiness and its History

The history of what can a human being achieve in terms of "Happiness" itself is quite varied according to time and space. I came across this book review on the economist which talks further on the same subject. The Name of the book is "Happiness: A History"Including where did the simely face came from? :-)

Quite Interesting Subjects

Sunday, March 12, 2006

Tuesday, February 21, 2006

Gulfood

What stuck me most interesting was the number of decision factors involved in setting up a restaurant or a fast food centre. I will try to list all the stages involved. Please comment if i missed some intermediate step.

1. Chef: The most important decision in setting up a restaurant is the chef. Restaurants make or break due to this. With chef, the decision on type of food that will be served is also decided. (Based on the chef's speciality)

2. Location: This goes hand in hand with step number one. Location is important because location determines most often the demand and supply of everything including customers and ingredent availablity. Location also determines to some extent the final price to be charged, since fixed costs are determined at this level.

3. Kitchen Equipment: Basic utilities for cooking and any other specialised equipment.

4. Interior decoration/furniture/crokery: This ranges from Basic tables and chairs to utilimate customization of interior experience.

5. Staffing: You need to staff both your kitchen as well as your restaurant.

6. Suppliers: Food suppliers.

7. Other stuff: Menus, Point of Sale Machines, etc

In addition to preparing food, a large section of the trade show was dedicated to the packaged food, both fozen and ready to eat. The trade show was divided into various geographical locations, that is, various countries and each section showcased their own food and other specialized equipment.

Sunday, February 19, 2006

VAT instead of duty!

This is good news for the financial system of UAE. And, unlike what most people who are against the VAT think, the VAT system will be a replacement for the duty system(which charges 5% right now), and should not raise the prices beyond the current inflation levels. However, considering that the present inflation is towards the high levels, most of the blame will go towards any new taxation system introducted.

One should keep in mind that VAT is not an income tax, and Salary will continue to be tax-free, unlike rest of the world.

Wednesday, February 15, 2006

VAT!! NOT!!

So, should they go ahead now? IMF wants it. GCC as a whole should be under somekind of taxation should they go ahead with the plan to unify the economices and have a common currency (Also in the news nowadays). I am not sure if taxation should be the first common link in economies of GCC countries, but some kind of regulatory authority over all the countries financial systems would be a good starting point. Taxing some percentage without any central authority to regulate and manage it would be futile.

Individual countries of the EU have all the institutions in place for decades, they know the freedoms and responsiblities. Still EU economy is a mess, with all regulatory rules broken time and again. Example is germany's budget deficit. Without Individual countries of the GCC implementing their own instituational history and having their own populations follow it, there is little or no point on implementing any cross-border mass regulatory bodies such as taxation board.

I would support some kind (or any kind ) of regulation which has control over financial sector of all the businesses in united arab emirates. (Not single institutions like DIFC or free zones) This country has some of the lowest Returns of Cost of Ownership and Return on Capital. As somebody commented on their blog, dubai is building sand castles. Building is easier than maintaining it. Without good financial control and regulatory command, you will never know how well your country and your firm is doing.

Lastly, there is no point in doing something, just because your neighbor did it.

Monday, February 13, 2006

Guardian Unlimited | The Guardian | Boom town

This is the Dubai sandwich: at the bottom, cheap and exploited Asian labour; in the middle, white northern professional services, plus tourist hunger for glamour in the sun and, increasingly, a de-monopolised western market system; at the top, enormous quantities of invested oil money, combined with fearsome social and political control and a drive to establish another model of what modern Arabia might mean in the post-9/11 world. That is the intriguing question: can Dubai do what Libya, Egypt, Palestine, Lebanon, Syria, Iraq, Yemen, or almost anywhere else in the Arab world you might like to mention, have failed to do? Is Dubai, in fact, the fulcrum of the future global trading and financial system? Is it, in embryo, what London was to the 19th century and Manhattan to the 20th? Not the modern centre of the Arab world but, more than that, the Arab centre of the modern world.

Few have spelt out the truth better.

Read more at www.guardian.co.uk/g2/s...

Thursday, February 09, 2006

Any Great companies in UAE?

Most of the management comes from forign nations, whose main objectives, according to the owners themselves, is to increase profits and market share. Dubai is a society of salesmen and consumers. Any activity not related to the above, is not encouraged, nor of any concern to the owners. There is little or no accountancy practices and stuff that exists is mainly adhoc, dependent only on which country the accountant comes from. (Audited balance sheets are very recent trend). R&D is limited to oil and gas industry, or maybe some few companies spread out.

The biggest drawback in UAE's economy is the time-limitedness of its employees. With no prospect of settling down for most of the population, it is mainly a city to work and earn. Not to re-invest. Visions, other than in locals, is limited to 3 years max. Increase your earning power as much as you can, and move. Within industries, the demand for trained individuals locally is high mainly due to high costs of training. No owner wants to train prefect employees, least somebody offers them higher wages. And finally, there is always a threat that business rights in dubai is very grey in color. Even after all the "free-zones" of the world. All said, none of the other countries in the region even provide this level of comfort. So you are left with no choice.

Wednesday, February 08, 2006

Borders in Dubai!!

For those who don't know, Borders (along with B&N) is supersize bookstore chain based in united states. I used to live next to one, and spent many an enjoyable weekends (infact most of them) browsing books and drinking coffee at their cafe. It is probably one of the most important lifestyle adjustments i had to make, while deciding to move to dubai. I really hope the shopping experience is same as in united states, since the idea of buying a book without reading the first few pages is deadful. 99% of the books cant be judged by their cover. Unforunately, except virgin megastore in MoE, all bookstores srinkrap their books. As if knowlegde inside the books will escape if somebody start to browse through it.

With major websites like Amazon and Google Print letting you browse and search through dozens of books at once, the idea of srinkraping is laughable. And i am talking of legitimate methods only. Audio books are rapent in peer sharing websites and ideal for dubai like environment where being stuck in traffic seems to be the most favorite passtime for everybody. I am presently listening to ""Lord of the rings" books; having completed the whole harry potter series.

Monday, February 06, 2006

Cartoon Politics

I agree with most of the islamic world that the cartoons were of bad taste. And probably, placing a lawsuit against the company would be a good justification against it. However, the cartoon become a classic case of tipping point, where the full effect has come to realization after almost six months and a few reprints. I will not be suprised if a world war breaks out due to this (It is important to note that wars have broken for lesser reasons!!).

Still jokes aside, the only benefiters of this campaine against danish dairy food industry (boycotting of products) are the fundamentalists as well as saudi dairy industry which is welcoming all the extra business revenue generated. (Denmark and finish companies traditionally have market shares of nearly 50%, if not more!!) Not that they would be infavor of any protests, atleast officially. I am not sure but i believe saudi royal family has some stake in the dairy industry.

Thursday, January 26, 2006

In response to the discussion on real estate

Dubai property market will go down in the years to come. However, Unlike the NY in 1920's, global economy will not let it crash. In recent histroy, the closest boom in real estate this size comes from of Singapore and HK.(And to some extent the building boom of southeast asia, through not limited to one city). Most of the property market in UAE, infact more than 80%, is in the hands of selected few, making such a crash very unlikely. Unlike the liquidity problems of southeast asian crisis in the year 1997 when global money flowed out of the nations almost at once, high oil prices will cushian any rapid outflow of money. Considering that most of the budget plans for these investments were make keeping in mind of oil at 35$ per barrel, UAE and broader middle east has plenty of money.

Wednesday, January 25, 2006

The Business Section of Gulf News

However, today's Headline was too much to bear. It is an expert advise that the year 2006 "stock market" will correct itself. Half of the blame goes to the middle east analysts. Most of them are unknown to the general public and any "expert" is subject to the paper or the company he or she works for. The second part is having analysis as part of the news reporting section of the paper. When you look at the headlines, you expect news not analysis except when analysis is done by a newsmaker.

Yallo!!

Too busy to write on anything particular. Busy with work and everything that goes with it. I am presently debating weather to start preparing for CFA - Charatered Financial Analyst. The main issues are the time and continued interest. I am so used to the idea of class room study or group study that the thought of preparing for the examination alone is not very pleasant. However, on the other side, i do not want to spend any money going to coaching classes. Moreover, i did not hear about any good coaching classes here in the middle east. Do you know any such courses which are good? R you trying to study for the level one of the examination? If so, drop me a comment and we can try to get together (If you are willing). I promise to delete the comment of any private information!!